By Tim Weizer | May 2016

In May 1992, the Wall Street Journal bluntly stated, “Nothing positive happens in the absence of revenue.” This statement is equally true today. An organization’s salesforce, and its effectiveness to generate revenue, can be significantly enhanced by the role of the HR function.

Of the many diverse drivers of salesforce effectiveness, 2 topics are worth a brief discussion. Under the topic of People are the success profile, hiring and training/coaching of the salespeople. Under the topic of Activity Enablers are the incentive plan and performance management program.

People

When it comes to salespeople, the chief human resource officer (CHRO) and key HR staff are seen as having a special skill in judging people and recognizing a person’s hidden talents. Whether judging a sales representative’s skills as a “hunter” or “farmer,” or judging the skills of a regional sales manager for higher management positions, human resources needs to not only consider today’s business and competitive environment, but also the future needs of the organization relative to its growth goals. In this regard, the CHRO is seen as having a special knack similar to the CFO’s skill in making inferences from the company’s numbers.

In addition, the CHRO and HR staff are key in two other areas. The first is diagnosing personnel problems that may arise when the sales function is not performing well. Is it because of the mix of talent, the reporting relationships or the absence of strong, cross-functional working relationships? These are all questions to be answered.

The second area is prescribing actions that will add value to the organization. For example, keeping tabs on the senior sales executives of competitors can lead to making meaningful predictions not only on how the competitors may be changing their overall sales strategy, but also on whether competitors may be looking to steal away your sales stars that fit their new sales strategy. One option for retaining sales stars is built on the long-standing premise that sales stars see pay as a personal scorecard. Some companies increase the impact of individual performance through an individual multiplier to incentive earnings.

Activity Enablers

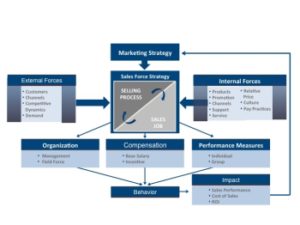

The CHRO‘s role in this area may often be viewed as limited to understanding the duties and responsibilities of individual sales positions and matching their compensation with the relevant marketplace. A growing trend, however, is for the HR function to go beyond that point and look at a broader picture. Namely: What is the importance of the sales position? What value does an individual salesperson contribute to the company? And, what should be the relevant base salary and incentive opportunity given the answers to those 2 earlier questions?

In this regard, the CHRO is seen as the team leader in joint discussions with sales management, the CEO and CFO.

Why This Perspective Is Barely Evident

A lot has been written about the HR function and its lack of strategic focus. Everything from its transactional nature to the many new legal aspects of the function, to a lack of budget, to not enough headcount. A recent Google search on the topic of “Strategic HR” yielded more than 250 million listings. So, there is a lot of ongoing discussion.

In my opinion, there is an important reason why this perspective is not more prevalent today. The senior leadership team may view the CHRO as too HR academic and not analytical. One way to combat this notion is for the HR team to conduct some sales incentive plan analytics that depict the performance level of the current plan. For example, comparing the actual distribution of performance across the salesforce with the expected performance and then determining if these results correlate with the organization’s financial performance.

Likewise, the HR function could begin to develop an analytical or behavioral-competency-based success profile of the company’s superior salespeople in order to improve sales effectiveness and efficiency.

Broader Actions

To begin the process of becoming a strategic partner to the CEO and CFO, the CHRO may also want to consider these broader actions:

- Ask to attend meetings where the CEO and CFO discuss not only quarterly results, but also talk about the company’s strategic plan and objectives. Take note of areas where the salesforce will be important for success (e.g., a new product introduction in a B2B marketplace).

- Collect data about the results of recent key activities that involve the sales function and use analyses to improve the working relationship between sales and other functions. For example, collect and analyze data on successful new product introductions and the interaction of the salesforce with marketing, engineering and other important functions seeking to improve the existing structure and/or processes.

Contents © 2016. Reprinted with permission from WorldatWork. Content is licensed for use by requestor only. No part of this article may be reproduced, excerpted or redistributed in any form without express written permission from WorldatWork.

3 percent reported by surveyed companies in 2016. These projected and actual salary increases have remained nearly constant over the past several years. Likely this trend (or lack thereof) reflects employers’ consistent conservative increases in salary’s fixed costs.

3 percent reported by surveyed companies in 2016. These projected and actual salary increases have remained nearly constant over the past several years. Likely this trend (or lack thereof) reflects employers’ consistent conservative increases in salary’s fixed costs.

Setting the same percentage of base salary as the incentive for target performance for all sales positions is often evidenced in plans. Careful sales job analysis should be undertaken to properly reflect each position’s impact and influence on a sale. This analysis then becomes an important part of determining the right pay mix per sales position.

Setting the same percentage of base salary as the incentive for target performance for all sales positions is often evidenced in plans. Careful sales job analysis should be undertaken to properly reflect each position’s impact and influence on a sale. This analysis then becomes an important part of determining the right pay mix per sales position.